To prev. page

2023 BOJ-IMES Finance Workshop

The Institute for Monetary and Economic Studies (IMES) of the Bank of Japan (BOJ) held the Finance Workshop online on November 10, 2023. In this ninth edition of the workshop, under the theme of “Market Frictions in Financial Markets and Price Formation of Financial Assets,” Professor Kazuhiko Ohashi (Hitotsubashi University and Tokyo Institute of Technology) delivered a keynote speech, and two research presentations were given by IMES staff.

1. Opening Remarks

In the opening remarks, Ken Chikada (Director-General, IMES) pointed out that the theme of this year’s workshop has been conventional and central one in the field of finance research. Recalling the first workshop in 2009, which featured developments in financial engineering after the global financial crisis (Reference 1), he stated that the current workshop would allow us to see how finance research has developed over the 15 years since the first workshop. Regarding the first research presentation, he described it as having various useful implications from academic, practical, and policy-related standpoints, emphasizing that it uses a granular dataset to quantify carefully the impact of the regulatory reforms on over-the-counter (OTC) derivatives markets that took into account the lessons learned from the global financial crisis. Regarding the second research presentation, he described it as a useful guidebook that helps deepen our understanding of new trends in volatility research, one of the core topics of finance research, since it provides an overview about the significance, characteristics, and background of a new idea that has recently been spreading in the field.

2. Keynote Speech

Professor Ohashi pointed out that the two research presentations in this workshop have two common ingredients: market microstructure (MM) and alternative data. He then overviewed recent trends in finance research, discussing how the two presentations are related to these trends.

The traditional MM research has been analyzing how asset prices and liquidity are influenced by microstructural factors, including the behavior of major market participants and the institutional structure of dealer markets or limit order markets. Professor Ohashi began by pointing out that in recent years an increasing number of studies have extended the traditional agenda by focusing on the implications of constraints on major market participants’ behaviors due to market frictions. In particular, he emphasized that limits of arbitrage, a phenomenon in which market frictions prevent the participants from sufficient arbitrage activities, has become a major research topic in the broader MM research field. He noted that with limits of arbitrage, asset prices could deviate from the fundamentals, and investment behaviors of specific investors or irrational investment behaviors may affect asset prices. He also noted that these issues have recently been studied for a wide range of financial assets.

Professor Ohashi then pointed out that the two presentations address perspectives from MM research with the former discussing the impact of regulatory reforms on price formation and the latter analyzing potential investors’ behaviors that may induce rough volatility.

The use of alternative data can be described as an attempt to expand the scope of the available data in terms of type, granularity, frequency, and so on. Both of the presentations could be seen as an example of such an attempt, because the first presentation uses highly granular data on OTC yen-denominated interest rate swaps at individual transactions level, and the second presentation uses high-frequency data. Professor Ohashi stressed that the use of alternative data and MM research are not mutually independent and affect each other, as the former broadens analytical viewpoints and uncovers new findings.

Finally, Professor Ohashi stated, as future research agenda in asset pricing, the importance of analyzing how determinants of liquidity in the DeFi (Decentralized Finance) market differ from those in traditional financial markets, where dealer inventory plays an important role, and how such new markets interrelate with traditional financial markets, taking as an example automatic market-making in the crypto-asset market.

Below are the contents of the two research presentations.

3. Research Presentations on the Impact of OTC Derivatives Market Reforms on Interest Rate Swap Prices

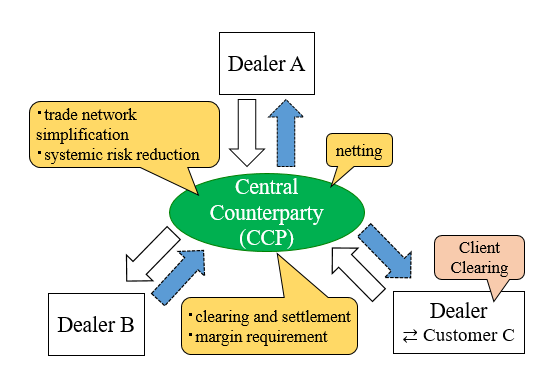

Since the global financial crisis, in accordance with the international framework, mandatory central clearing of standardized OTC derivatives transactions (since November 2012), and margin requirements for non-centrally-cleared transactions (since September 2016) have been implemented gradually in Japan for the purpose of preventing systemic risk arising from counterparty risk (Figure 1). Takemasa Oda (Director, BOJ) presented an empirical analysis of the impact of these market reforms on transaction prices of interest rate swaps in Japan, based on Miyakawa, Oda, and Sone [2023] (Reference 2) and Sone, Oda, and Miyakawa [2023] (Reference 3), which use transaction-level data on OTC yen-denominated interest rate swap markets reported to the Financial Services Agency (joint work with Taihei Sone (BOJ) and Daisuke Miyakawa (Waseda University)).

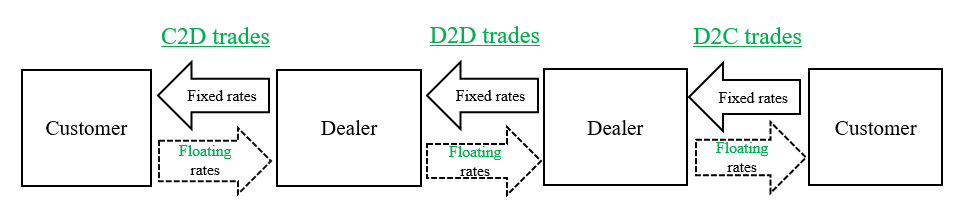

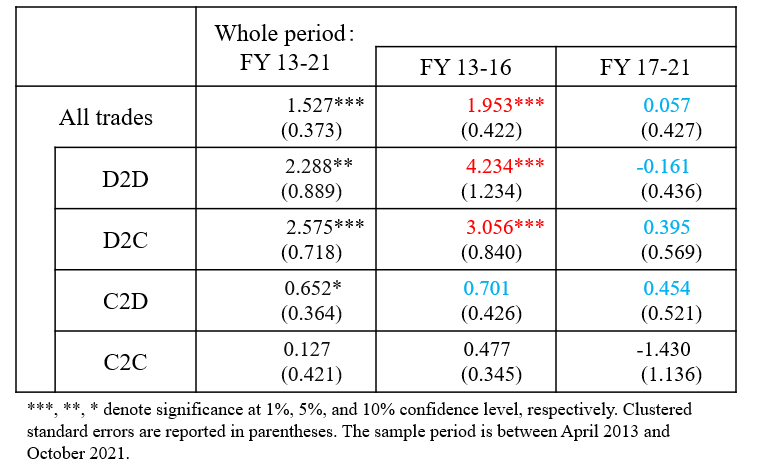

This study quantitatively evaluates whether a price difference (OTC premium) existed between centrally- and bilaterally-cleared interest rate swap transaction prices during the transitional period to tighter financial regulations. The analysis estimated how OTC premiums differed by the timing of transactions (classified by phasing-in-periods) and by the type of combination of trading participants, using detailed transaction record data (Figure 2).

The estimation results show that the OTC premium, albeit small, existed asymmetrically between dealers and other entities in the period after the mandatory clearing was in place and before the margin requirements came into effect (2013-16, the column “FY 13-16” in Figure 3). That is, a statistically significant OTC premium was observed for transactions in which dealers received fixed rates (D2D or D2C transactions). This indicates that interest rate swap prices were significantly higher for bilaterally-cleared transactions than for centrally-cleared transactions and that dealers, who are considered to have pricing power, may have incorporated the counterparty’s credit costs and other factors into swap prices in the bilateral transactions. By contrast, for transactions in which other entities receive fixed interest rates (C2D or C2C transactions), no statistically significant OTC premiums were found. In addition, it is likely that the OTC premium has increased temporarily immediately before and after the introduction of margin requirements, but have gradually disappeared in the latter half of the transition period (2017-21, the column “FY 17-21” in Figure 3) as the scope of margin requirements was expanded.

The discussant, Professor Wataru Ohta (Osaka University), emphasized that the changes in OTC premiums uncovered in this presentation were important as they implied that the market reforms have affected interest rate swap transaction prices. He then argued that it would be desirable to examine factors that affect dealers’ pricing behaviors, such as their ability to raise funds, as other potential causes of the OTC premium, in addition to dealers’ pricing power addressed in this research and previous studies. He also argued that a future research topic could include a detailed analysis of the contribution of dealers’ pricing power by classifying customers according to their characteristics.

Understanding the impact on markets of the tightened financial regulations is important for policymakers when monitoring markets and considering future regulatory landscapes. From this aspect, an increase of quantitative analyses based on the data is beneficial as more granular data with detailed information on individual transactions becomes available.

4. Research Presentations on Rough Volatility

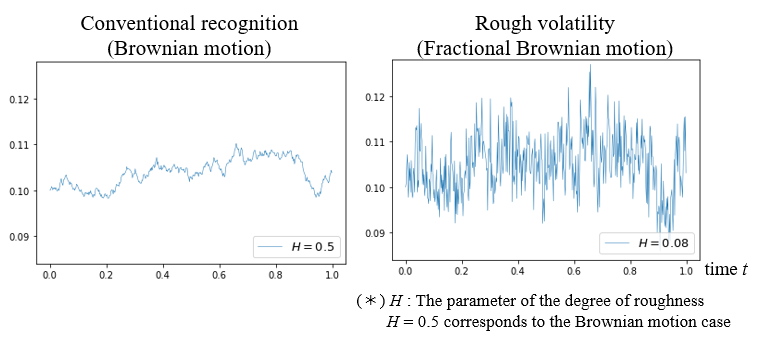

Yuji Shinozaki (Deputy Director, BOJ) gave a presentation on rough volatility, a new trend in volatility research. He explained how research on rough volatility has developed and discussed future research directions (joint work with Kazuhiro Hiraki (BOJ)). Rough volatility is a theoretical property where the time evolution of volatility is more volatile (“rough”; Figure 4, right) than what has been conventionally recognized in finance theory and financial trading practices (Figure 4, left).

Dr. Shinozaki began by summarizing the three main areas in which rough volatility has been studied: time-series modeling of volatility fluctuations, pricing and risk management of derivatives, and studies on the mechanism of asset price formation. He then explained that recent research results indicate the need to consider the concept of rough volatility as an overarching topic across these multiple fields. He also discussed its applicability to practical issues in finance.

First, regarding the time-series modeling, he introduced a study by Gatheral, Jaisson, and Rosenbaum [2018] (Reference 4). This study shows that the behavior of realized volatility estimated from high-frequency data (daily volatility calculated from intraday data) is rough, and that accounting for roughness can improve the accuracy of volatility forecasts.

Next, in relation to the pricing of derivatives, he introduced a study that argues that volatility may be rough given the characteristics of implied volatilities calculated from various derivative prices, especially the actual shape of implied volatilities in very short maturity zones, on which the risk of sudden market changes tends to have a strong impact. He also referred an important theoretical result (Fukasawa [2021]) (Reference 5) that in markets where roughness is observed, arbitrage opportunities will arise if a pricing model does not take roughness into account.

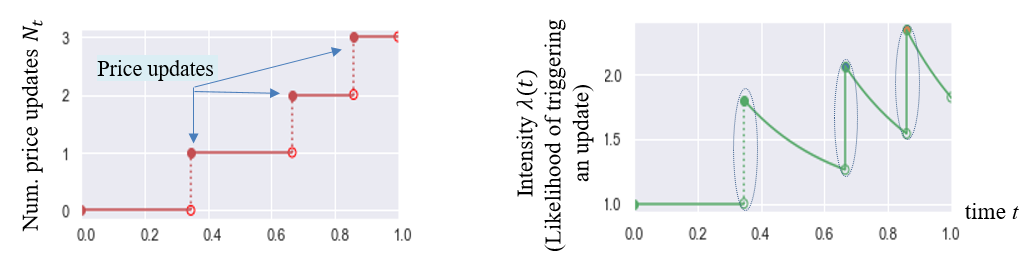

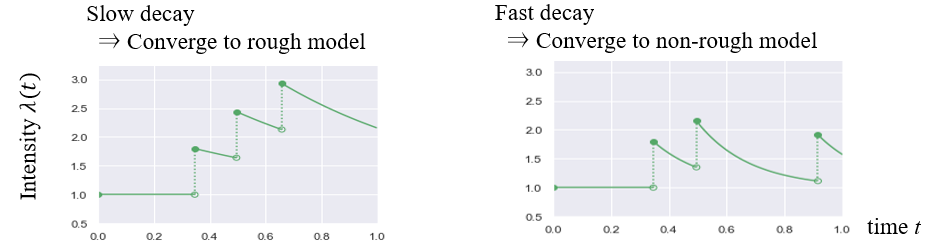

Finally, regarding the mechanism of asset price formation, he shared a result of a study that examines the mechanism of how roughness in price volatility arises by modeling market participants’ ordering behaviors using a stochastic process called a Hawkes process (Figures 5 and 6) (El Euch, Fukasawa, and Rosenbaum [2018]) (Reference 6). A Hawkes process models the occurrence of random events (in this case, price updates), where once an event occurs, the likelihood (intensity) of subsequent events increases. It has been pointed out that this behavior may be observed when an investor splits large trade volume into smaller trades and executes them gradually.

The first discussant, Professor Toshiaki Watanabe (Hitotsubashi University), pointed out that previous financial econometric studies may have overlooked the significance of roughness and that there is room for various refinements in rough volatility studies, for example, in the treatment of the bias in realized volatility caused by microstructure noise and in tests for the statistical significance of improvement in the accuracy of volatility forecasts. The second discussant, Professor Masaaki Fukasawa (Osaka University), pointed out that taking rough volatility into account could lead to improvements in risk management, since it could solve some difficult issues in constructing derivative pricing models, such as expressing short-term fluctuations in volatility and the term structure of the correlation between asset prices and their volatilities.

How to model uncertain movements of asset prices is an important topic for the purpose of both risk management and financial regulation. It is expected that academic research on rough volatility as well as research on its practical applications will continue to advance, leading to further improvements in practice within the finance industry.

5. Closing Remarks

In his closing remarks, Masaaki Kaizuka (Executive Director, BOJ) stressed that the theme of this workshop implied a return to traditional finance research issues. He also stressed, however, that the two research presentations had a common theme in using alternative data that reaffirmed the continued development of finance research alongside data science research, which had been a feature of previous workshops, referring to Professor Ohashi’s keynote speech.

He stated that, from the standpoint of policymakers, it is important to conduct analysis using reported data effectively and to return the fruits of such analysis to the public, as in the first study. He also stated that it is important to deepen our understanding of important findings from the analysis of high-frequency data that may have an impact on risk management, asset management, and regulatory frameworks, as in the second study. He concluded the workshop by stating that the IMES would like to continue to contribute to discussions with researchers and practitioners by holding workshops in the coming year and beyond, among other activities.

The affiliations and titles listed here are as of the time of this workshop.

References

Click on the number at the end of the document to return to the main text.

- Bank of Japan, “Finance Workshop ni okeru Paneru Toron ‘Kinyukiki go no Kinyukogaku no Tenkai’ no Moyo,” Kin’yu Kenkyu (Monetary and Economic Studies), 29(3), Institute for Monetary and Economic Studies, Bank of Japan, 2010, pp. 1-18 (in Japanese). (1)

- Miyakawa, Daisuke, Takemasa Oda, and Taihei Sone, “Regulatory Reforms and Price Heterogeneity in an OTC Derivative Market,” Bank of Japan Working Paper Series 23-E-12, Bank of Japan, 2023. (2)

- Sone, Taihei, Takemasa Oda, and Daisuke Miyakawa, “Tento Deribateibu Shijo Kaikaku ga Kinri Swappu Kakaku ni Oyoboshita Eikyo,” Bank of Japan Research Laboratory Series No.23-J-2, Bank of Japan, 2023 (in Japanese). (3)

- Gatheral, Jim, Thibault Jaisson, and Mathieu Rosenbaum, “Volatility is Rough,” Quantitative Finance, 18(6), 2018, pp. 933-949. (4)

- Fukasawa, Masaaki, “Volatility Has to Be Rough,” Quantitative Finance, 21(1), 2021, pp. 1-8. (5)

- El Euch, Omar, Masaaki Fukasawa, and Mathieu Rosenbaum, “The Microstructural Foundations of Leverage Effect and Rough Volatility,” Finance and Stochastics, 22(2), 2018, pp. 241-280. (6)